Most homebuyers and even homeowners who already have a mortgage and looking to refinance. But they don’t know what to look for in a mortgage lender, or even how to find one.

They likely lack an understanding of the lending process, how mortgage rates work, and the ideal mortgage for their situation. All of these questions lead hundreds of thousands of prospective mortgage customers to Google each and every day—mortgage leads!

This is your opportunity to learn—and why you should be learning—how to generate leads online.

But, how do you get these prospects from the search engine or social media page to an appointment with a loan officer?

That’s exactly the purpose of this ultimate guide to mortgage leads.

Whether you’re purchasing leads, learning to generate your own, or looking for a mortgage marketing agency to do it all for you, you’re going to find a roadmap to more leads and ultimately more closed loans.

Get a head start working leads. Buy your mortgage leads here.

Everything you need to know about generating leads

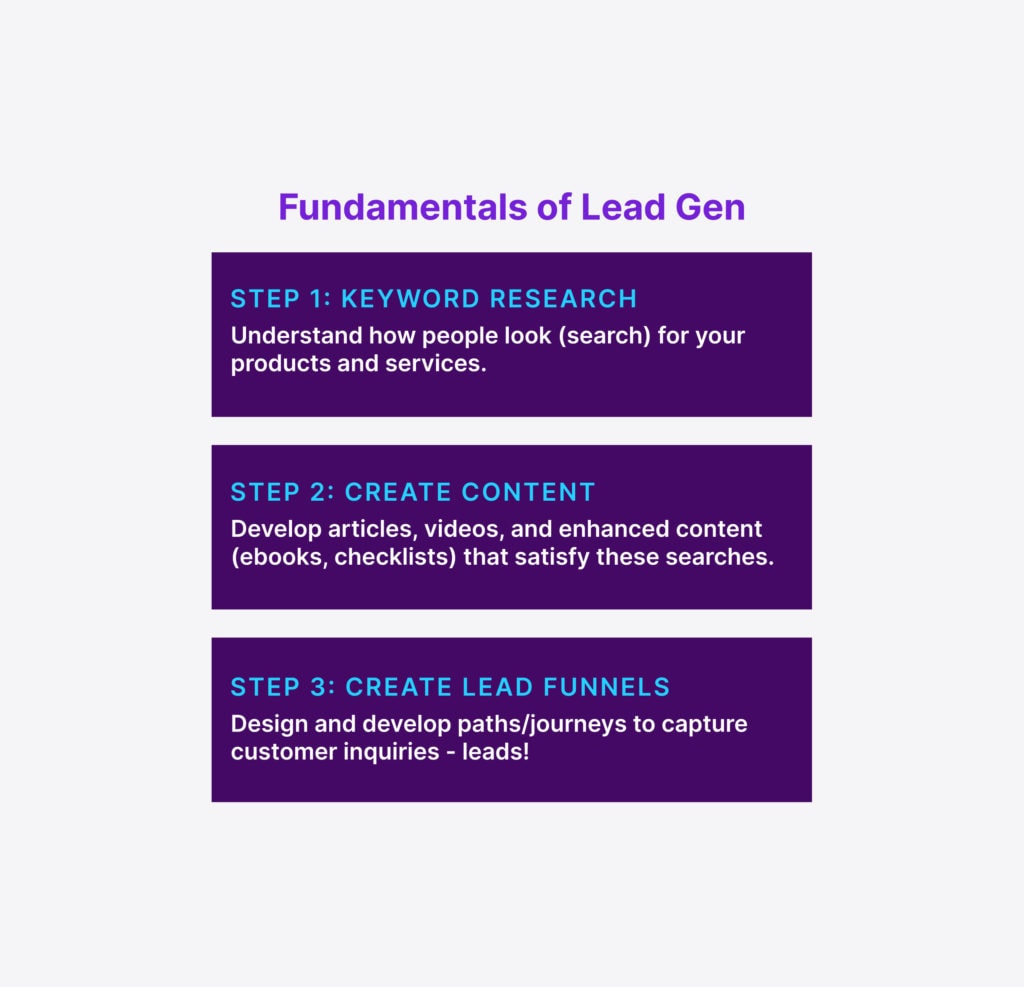

Generating leads can seem complicated, but you’ll start to gain massive results if you simply keep in mind a few basics.

Step 1: Understand how people search for your products and services. The best way to do this is by doing some basic keyword research using SEO tools like Semrush, Ahrefs, and Ubersuggest in conjunction with data from your website’s own Google Analytics and Search Console.

These tools show you exactly what keywords people are putting into search engines to find mortgages, lenders, and loan officers. Now, you just need to get into those searches. That brings us to the next step to generate leads — creating content that ranks.

Step 2: Create mortgage content that ranks. Using your keyword research begin to write articles that answer those questions and satisfy the keyword searches that you discovered. Publish these articles on your website (I recommend a WordPress website). Ideally, you want to write several articles that cover these core topics from a lot of different angles. For example, if you are targeting first-time homebuyers you might want to write articles about FHA loans. But you also want to write about credit scores, down payments, and anything that might be on the mind of a new homebuyer.

Step 3: Create lead funnels. These are paths that you create on your website to guide people to schedule an appointment with a loan officer.

In a nutshell, that’s the basics of generating leads.

With this foundation, let’s get into the nitty-gritty of mortgage lead generation.

Building a mortgage lead funnel

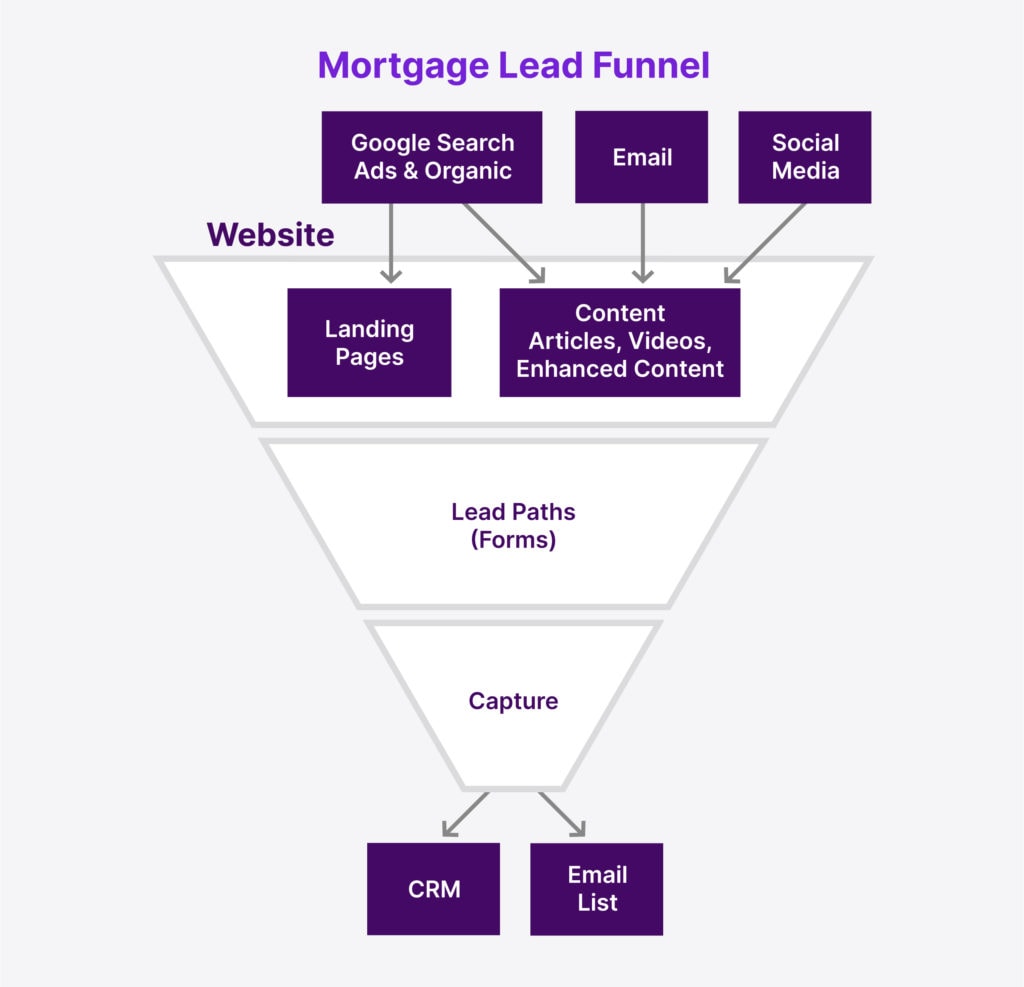

Most lead generation methods use some form of a funnel to guide prospects from an informational search to converting into a lead. These are typically a request for a mortgage rate quote or loan options.

You can think of your lead funnel as a simple roadmap from learning about mortgages to looking for a mortgage broker or lender, and finally to filling out your lead form to meet with a loan officer.

Sounds easy enough, right?

Conceptually, yes. However, there are several critical components that need to be built and processes that need to be consistently executed to provide a steady flow of fresh leads.

A great mortgage website

One of the biggest failures I see in mortgage brokers attempting to generate mortgage leads is their website. The assumption that an attractive website is all that it takes to generate a lead is a false assumption. That thought will cost you thousands of dollars and never generate a positive ROI.

A mortgage lead generation website takes into consideration what you need to teach, promise, and assure the visitor. This path, the user interface that allows the user to navigate through this process, needs to be clear and intuitive. But, it doesn’t end there. Then the overall aesthetic and usability need to be clean, professional, and accessible.

Altogether we refer to this as user experience design.

Without expertise in designing mortgage websites that generate leads, you’re likely to get just a mortgage website—a guaranteed waste of money.

Let’s get really practical and detailed on what to look for in a great mortgage website. Here’s my quick checklist to ensure you have all of the basic elements to turn curious visitors into mortgage leads.

- Home page – Start with a strong positioning statement (what makes you unique?). And an immediate call to action to purchase a home or refinance a mortgage. The balance of this home page should convince the visitor that you are here to educate and help. This pitch generally includes a section on the benefits of working with you, your process, and a handful of helpful articles, and clear and conspicuous contact and compliance information.

- Branch and loans officer pages – Even if you’re a consumer direct lender, showcasing your local branches and associated loan officers can humanize your brand. It can make the consumer feel more at home that they are working with their kinda people.

- A reviews page – Notice I intentionally called it reviews, not testimonials. People search for Hometown Lender Reviews, not Hometown Lender Testimonials. They want to know what other people say about you. So, make sure that you control that perception by harvesting your best reviews from Google, Facebook, Zillow, Bankrate, or wherever else customers leave reviews. Make your own page and control that critical search keyword. Here’s an example of a mortgage website’s reviews page.

- A mortgage rates page – People want mortgage rates. Even if you can’t display your own loan product rates, at least create a rates page that shows visitors the current mortgage rate trends and news. Here’s an example of one of our mortgage website’s rates pages.

- Lots of mortgage content

- Very specific loan product and borrower situation landing pages

- Clear easy to complete mortgage lead forms (paths)

Build all of this on a solid content management system hosted on a premium web hosting platform.

This might seem trivial, but your tech stack is just as important as your web design and content. Why? Because Google demands speed and consistent, error-free performance to be listed in their search engine. There are several options, but I strongly recommend WordPress sitting on WPengine.

Resist the urge to get $5 web hosting or slap something together on Wix, Studiopress, or Webflow. These all have a place in the general website market, but they will not afford you the customization and performance to generate mortgage leads in an incredibly competitive industry.

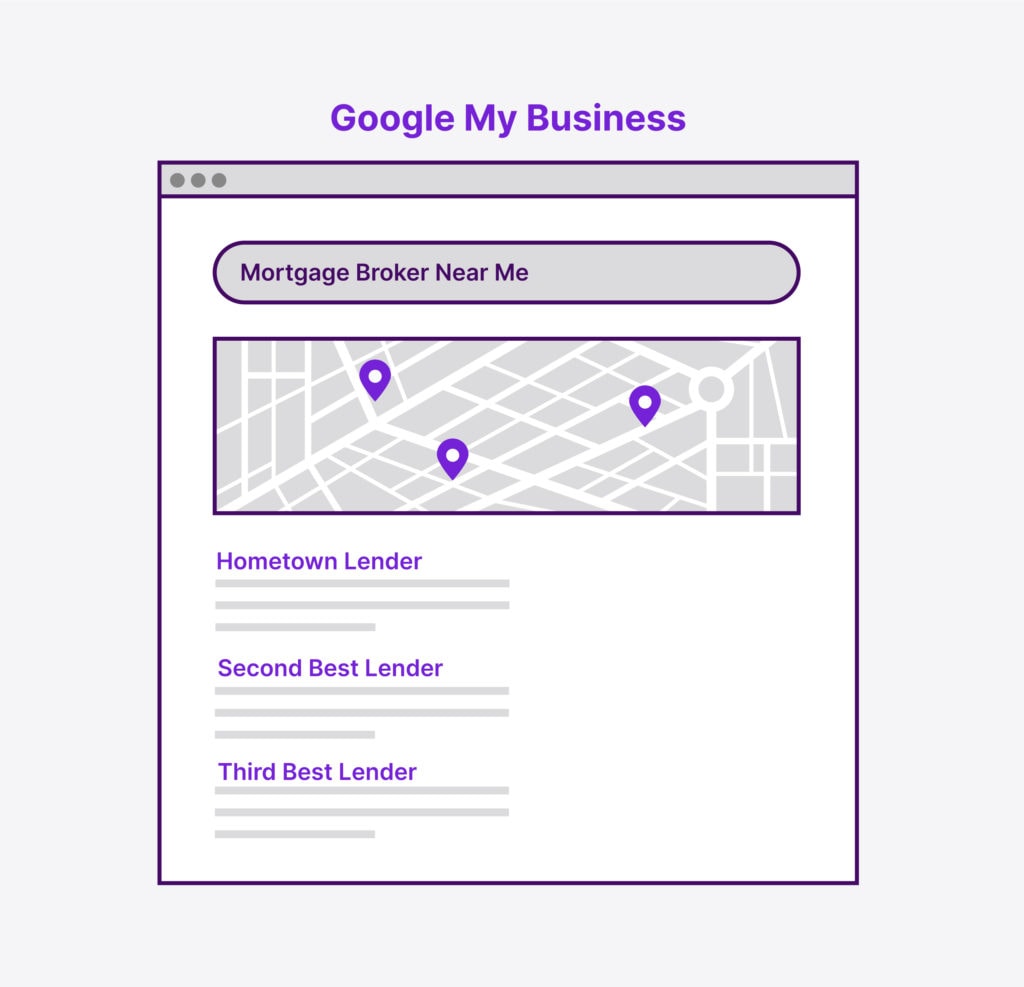

Google My Business for your mortgage branches

Google My Business is the best way for your local branches to start showing up in local searches. Even as most people go to the internet for every little need, they still like to find a local person.

Google My Business allows you to list your local branches and even loan officers in their home communities. And, of course, since it’s Google what do you think is going to come up towards the top of searches like mortgage broker near me? You guessed it — Google My Business listings.

In addition to completely filling out your Google My Business profile, it’s also critical that you start to stack your Google reviews with five-star reviews. Once your profile is set up you’ll have a link to give to every happy client. Using this link they can leave a Google review with a single click.

People trust Google reviews and the more positive reviews that you have, the better you will rank in Google searches. This is an essential part of any effective local SEO strategy and will contribute to generating more leads.

Simply make asking for reviews and sending that review link via emails and text messages a core part of your process.

I recommend asking for reviews immediately following the initial loan application call and closing. These tend to be the moments of highest client satisfaction. Avoid the mess center of loan processing. I also recommend leading the client in providing the right review with language like, “If you feel like I provided exceptional service, could you leave me a five-star review on Google? [link].”

Content marketing around common mortgage topics

Writing articles for your blog and recording videos for YouTube are two essential content marketing strategies. They will consistently grow, engage, and convert people looking into buying homes and considering their refinance options.

I often use the game Monopoly to explain how content marketing works.

The more premium real estate (search engine keyword rankings) that you acquire (content being the investment to purchase your real estate in Google) the more people will pay you (leads) when they land on those spots (keyword searches) as they travel around the game board (research their loan and mortgage broker options).

Content marketing is conceptually an easy strategy to understand —consistently publishing high-quality content (articles and videos). However, consistency and quality can be difficult to execute when mortgage lenders, necessarily, focus 100% of their efforts on sales.

My recommendation is to resource your SEO and content marketing execution to a dedicated individual or team. You can hire a contractor or freelancer to start a small program.

When you’re ready to take it to the next level, I would recommend hiring an experienced content marketing agency.

Pay-per-click advertising on high-intent mortgage searches

Pay-per-Click (PPC) advertising is another highly effective component of a lead generation strategy. Although it will generally produce fewer leads and at a high cost-per-funded loan, it has several advantages including:

- immediate lead flow

- better targeting

- typically higher quality, and often closer to a mortgage decision.

Google Ads is the best place to start and makes up over 92% of all online searches.

Facebook Ads is where I go next for additional lead volume. This platform is cheaper, but inherently lower quality. Mortgage leads generated from Facebook Ads are from impulse clicks from interruptions on people’s newsfeeds, not an intentional search for information.

The biggest challenges with any PPC advertising are the complexity of creating an effective ad creative, high converting landing pages, and managing an effective bidding strategy such that you generate leads and still maintain a positive Return on Advertising Spend (ROAS).

Getting this delicate balance right can set your mortgage company up for immediate, highly scalable, endless leads and ultimately loan production.

Social media marketing to inject mortgage news into newsfeeds

New home buyers and homeowners considering their refinancing options are often heavily influenced by social media and financial news. Considering this fact is why you also need to have some form of social media strategy in your mortgage marketing mix.

There are many channels and tactics to consider, but my standard framework usually starts with Facebook (and generally Facebook Ads, to shorten my time to start generating leads).

As your mortgage branch or company begins to grow and you need to scale leads, you can begin to layer in other social media platforms. However, staying focused — on ad quality and maintaining a positive ROAS — is key.

Once you have dialed in your Facebook campaigns it can generate significant lead volume.

Another effective way to use social media is to grab the attention of and recruit top real estate agent referral partners and other loan officers.

Creating campaigns that specifically target and help real estate agents and loan officers improve their skills and grow their businesses are great ways to identify and attract the best talent into your organization.

For these kinds of recruiting campaigns, I still like starting with Facebook but also have had some success running campaigns on LinkedIn, for obvious reasons.

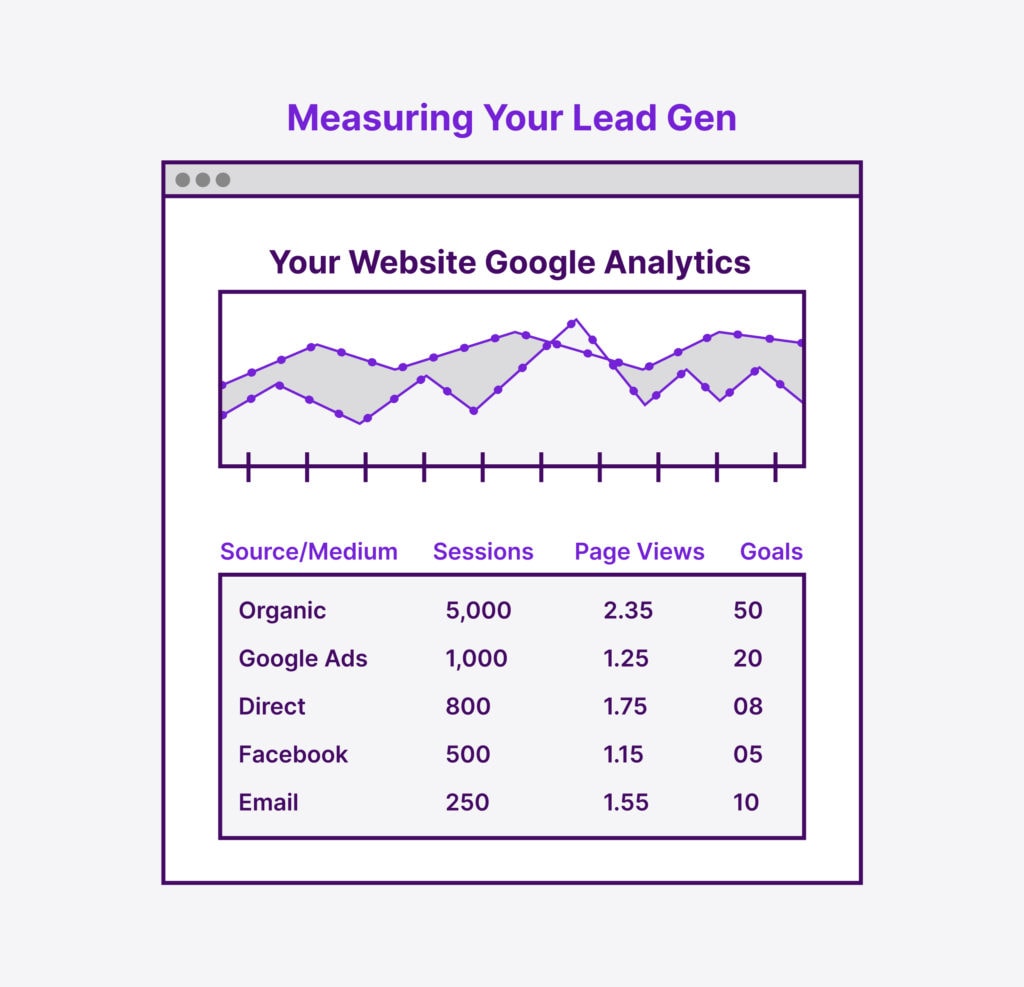

Measure your lead generation efforts

Now that you have your lead generation strategy and begin to execute that plan, it’s essential to measure and evaluate your efforts.

Each of the advertising platforms that you use, from Google Ads to Facebook Ads will have some form of analytics that you can use to optimize your campaign. However, your most important lead generation metrics are going to come from evaluating your website, where leads are generated.

Does generating leads yourself sound like too much work? You can buy mortgage leads here.

Google Ads and social media analytics to measure the engagement

Your advertising platform analytics can help you to gauge and optimize your audience engagement and attraction. Effectiveness here (generating clicks) helps you to turn targeted audiences into traffic on your website.

The key to success on these platforms comes down to the following Key Performance Indicators (KPIs):

- Keyword, geo, and interest targeting

- Advertising Click-Through- Rate (CTR)

- Landing page conversion rate

Use these measures to tune and secure consistent traffic to your website that you can turn into leads.

Google Analytics to track your mortgage marketing performance

Once you have visitors (potential borrowers) on your website, you need to guide them into your sales funnel. Designing sales funnels can be a powerful tool and one of the best methods to generate a lead. But, how do you know if that sales funnel is working?

Google Analytics is an incredible tool for gaining insight into sources of traffic, user behaviors, and the effectiveness of your user experiences and lead paths.

Use these insights to determine if you are getting the right traffic, have the right design, copy and content to convince, and efficient CTAs and forms to capture that traffic and get them to your many loan officers.

Google Search Console to spot new mortgage search opportunities

Google Analytics monitors the behavior of visitors to your site. Whereas Google Search Console allows you to analyze your website through the eyes of Google.

Google Search Console lets you see the keywords and pages that are getting impressions within Google searches. This data can allow you to spot opportunities where there are lots of impressions, but your need to get your content to rank higher and grab those clicks.

The simplest strategy using Google Search Console is to find the keywords and landing pages with the most impressions and build SEO tactics around those pages that are closest to hitting page one.

Nurturing leads

The majority of your leads will not immediately turn into loans and many of them will be completely unresponsive. But, don’t assume that means they’re dead. Studies suggest that the majority of these leads will close – somewhere – in the next six to eighteen months.

We certainly don’t want our loan officers wasting time on huge lists of unresponsive leads, but we do want to be working on these leads. Lead nurturing and sales automation is the secret.

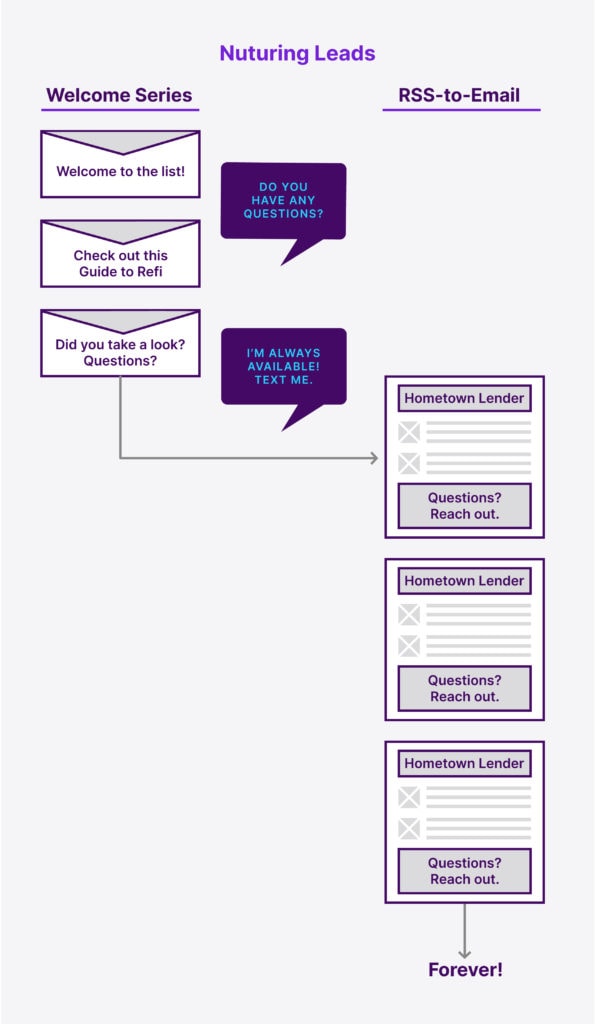

Every lead we generate or buy will go into a lead nurturing campaign.

These campaigns are simple sequences of emails, text messages, and voicemail drops. These campaigns are designed to keep in touch, be top of mind, and deliver valuable educational content.

I always say, “Leads never die. We just stop talking to them.”

Customer relationship management system for sales automation

As you generate or buy leads your database of opportunities will quickly grow. Before you know it you will be trying to manage and nurture thousands of leads. At this point, a customer relationship system is critical.

Most CRM systems come with marketing and sales automation features that allow you to work an unlimited amount of leads. Carefully and cleverly programmed, your CRM will trigger hundreds of people to return to your website and fill out another lead form – a fresh new lead!

On top of becoming one of your best lead sources, a good CRM can also take care of many of the mundane follow-up and scheduling tasks – keeping your sales team focused on conversations, not organizing leads.

Email marketing to stay top of mind for the indefinite future

Assuming you’re putting the strategies in this article to practice, your website is going to generate a lot of leads. But, a growing list of prospects is not the only list you can build. By using lead magnets – ebooks, rate alerts, or newsletters – you can also grow an email list.

Email marketing to this audience becomes one more source of lead generation.

One of my favorite email marketing tactics is to use RSS-to-email to turn my blog content into an automated email newsletter. One more way to increase the ROI on your content investment all while educating and staying top of mind with a growing audience.

Text messaging to send alerts, update, and spark new interest

Emails are still amazingly effective, but text messaging has become the most effective way to engage with mortgage clients.

Text messaging seems to have a beautiful blend of consumer preference and sales efficiency. Customers like it because it’s not as intrusive as a phone call and the sales team loves it because it is guaranteed to be seen by the client and it is easy to automate and personalize.

The proof is in the data. Response rates for phone calls are less than 2%, emails 4-10%, and text messages are between 20-40%.

Start using text messaging in your lead nurturing campaigns.

Buying Mortgage Leads

Generating leads takes both marketing and technical expertise. Consequently, getting started can be expensive and frustrating as you will invariably make numerous mistakes as you learn the craft.

If you’re not going to hire a lead generation agency to set up and run your program, then you might want to consider starting with buying leads.

Buying leads is a great shortcut to lead generation. When you buy leads you’re essentially hiring expert mortgage marketing professionals to do all of this stuff and hand you the finished product—a lead.

So, how do you find good lead companies with the best leads for your mortgage business?

Nonexclusive leads are the cheapest option

When you consider buying real-time leads, you have two broad categories – nonexclusive and exclusive leads.

Nonexclusive leads are the most popular mainly because they are the most affordable, but you should consider the trade-off. As the name implies, these leads are not just sold to you, but typically to four to five other lenders at the same time.

Therefore, it’s often a literal race to get the customer on the phone and secure the loan application.

As you can expect, this can be frustrating to loan officers that will likely hear over and over again, “I’m already working with Quicken Loans.” Or, “You’re the hundredth mortgage company to call me! Stop calling!” — Click!

But, some of that frustration is necessary to endure to get a $25-50 per lead price.

Exclusive leads are essentially outsourced marketing departments

The other option is exclusive leads.

These are leads that are generated and sold only to you. The advantage is that you will not compete with anyone and ideally the lead company will give you a somewhat warm introduction on the thank you page — “We’re referring you over to Hometown Lenders, our preferred lending partner.”

That sounds pretty good, right?

Of course, the downside is that you have to pay full price for that lead – anywhere from $150-200 per lead.

Your next question might be why so much. Actually, the explanation and math are pretty simple. The mortgage industry is one of the most competitive on the web for advertising. That competition drives up the price of advertising, clicks, and conversions.

Currently, it cost about $150-200 to generate a high-quality lead from Google Ads (or even with an SEO and content – organic – strategy). So, if you want that lead exclusively, you’re going to pay between $150-200 per lead. If you want that lead for $25-50 per lead, then I need to sell the same lead to five to six other mortgage companies to get that $150-200 and stay in business.

This is why as mortgage companies grow, they begin to generate their own leads in addition to buying leads.

Get affordable, quality mortgage leads here.

Aged leads are the fastest way to stuff your customer database

There is one more category of leads that can be a powerful part of your lead buying strategy—aged leads.

In a nutshell, these are internet leads, from real-time lead providers that have, as the name implies, aged.

The big advantage of this lead category is the steep discount. Instead of paying $25-50 per lead, you can usually get these leads for anywhere between $1-5 per lead.

Obviously, the downside is that typically these leads were generated days, weeks, or even months ago – on average 30-60 days old. So, many of the prospects may have already been helped. But, as you know from your own experience, many of these people take 30 to 60 to maybe six months to make a decision.

There is definitely gold to be mined from aged leads.

Aged leads are one of the best ways to quickly build a large book of business that can be harvested for leads and referrals years into the future. They also make for a great training database allowing your new loan officers to work hundreds of leads, getting the reps they need to become exceptional.

Lead filter criteria to get your ideal lead and loan type

Another advantage of buying mortgage leads is the ability to precisely filter for your ideal lead and loan types.

When you’re doing your own marketing you do your best to target the right audience, but you will invariably get several undesirable leads. When you’re buying mortgage leads you can filter by a variety of characteristics like credit, loan amount, LTV, loan type, and several others.

Lead companies, how to pick ’em

How to pick a great lead company is a topic all in and of its own, but there are a few good rules of thumb.

- They should have a professional web presence and easy-to-find contact information

- How they generate leads should be clear and simple to understand

- Pricing should be easy to understand

- There should be no long-term commitments or lock-ins

Most importantly, you should have a conversation with a sales representative. Ask lots of questions and get completely comfortable hiring this lead company as your marketing department.

Kickstart your business with mortgage leads from My Perfect Leads.

Find what works and double down

The most important thing that you can take away from this article is that you use this guide to outline your plan for generating sales leads and then test and measure.

Once you find a positive trend in traffic, leads, and closing rate — figure out how to double down and scale your marketing system.

Want to fast-track your mortgage lead efforts? Buy leads here.