At the heart of mortgage marketing today, there’s content marketing.

Nearly all homebuyers (95%) are using online tools throughout the home search process.

As an experienced mortgage loan officer, lender, or broker, your goal with content marketing is to help these potential online leads find you via engaging blog posts, clever videos, and beautifully designed infographics.

But how do you make that happen?

If you’re lacking in qualified mortgage leads and feel like you’ve exhausted all options in boosting these leads, it may be time to revisit your current content strategy.

Shortcut lead generation building. Buy high-quality mortgage leads now.

How to get mortgage leads

First, let’s establish what it means to have an online mortgage lead in hand.

This occurs when one of your website visitors submits their contact information to you through one of your web forms.

They might be submitting their information to access downloadable materials you’re offering, or to request information about a certain loan product or rate quote.

To get to this point, your website needs to be optimized for successful conversions. And to optimize your website, you need quality content.

In the past, a mortgage lead for loan officers primarily came from referrals. Today, this method is much more difficult to scale.

Instead of relying strictly on referrals, mortgage professionals can also either purchase leads or generate their own.

Purchasing leads can be a helpful way to get moving immediately or to snag leads during slow periods.

But ultimately, generating your own leads is ideal because you’ll gain access to exclusive leads that belong only to you.

The goal of a top-notch mortgage content marketing strategy is to avoid “slow periods”—you’ll have a consistent, steady stream of MLO leads coming through your website at all times.

Want to boost your pipeline without creating a lead gen machine? Start here.

Generate qualified mortgage leads with content marketing

How would you describe your current content marketing strategy?

Are you focused on creating blogs or videos? Do you consider your social media platforms to be the main player in your overall mortgage marketing content plan?

Content marketing is about naturally drawing in online mortgage leads with informative, entertaining content that answers their questions, addresses their pain points, and, most importantly, gets them to hit “Apply.”

An effective content marketing strategy for lead generation actually begins and ends with your mortgage website. Everything else exists to support and enrich it.

Your content marketing plan must be supported with SEO (search engine optimization).

SEO content helps search engines like Google connect with your copy and rank it. You want the highest-ranking content possible because the farther down your pages appear in search, the less likely they are to be clicked by users.

One component of SEO is including relevant keywords in your copy, but there’s much more to it than that.

Google will scan and rank your content based on several factors, including the following:

- Readability, or how easy it is to scan and digest the content

- Relevancy, or how well the content matches the search intent

- Use of internal and external links

- Length of the content

- Appropriate use of images

- Overall quality

It may seem surprising that Google can pick up on all of that, but it really can.

For example, AI-generated content is gaining in popularity as it gets more sophisticated, but so far it can’t compete with a thoughtful, well-written, and well-researched piece of content.

Bottom line: Give your content some serious attention, because it’s an essential part of your mortgage lead generation strategy.

There are several free tools you can use to help boost your rankings and generate more mortgage leads.

There are also plenty of paid tools that can supercharge your efforts if you’re planning to take lead generation seriously. We talk about these tools below.

Does creating content sound intimidating? Shortcut the process. Buy high-quality mortgage leads now.

Platforms for content marketing

Content marketing platforms range from full-service to certain components of content marketing, such as email or social media.

Most platforms include tools to plan your content, create it, optimize it, distribute it, and then measure the outcome with analytics tools.

Let’s look at some of the top platforms for mortgage content marketing in 2022.

HubSpot

If you’re looking for a full-service platform that offers marketing tools, sales CRM software, and customer support, HubSpot is a top pick.

While some marketing experts insist that an all-in-one isn’t any better than picking and choosing a combination of solid content tools, HubSpot works for mortgage professionals who would rather keep everything in one place.

You can get started with some free tools to try out the platform, including email marketing, ad management, and landing pages.

MailChimp

MailChimp used to be only an email marketing platform, so if you still have that idea of it you might be surprised to hear that nowadays it’s a full marketing platform.

Users can create a website with MailChimp, design landing pages, and launch ads on the web and social media.

It also has a full content studio, a subject line helper, and more than 100 email and landing page templates.

SEMrush

SEMrush is a powerful content marketing platform with tools for topic research and SEO, plus a marketing calendar, a writing assistant to check your SEO score, and tracking to measure your content’s success.

The content audit tool also can scan your copy to let you know which pieces could use an upgrade.

Brand24

Brand24 is a media monitoring tool that will help you stay on top of the discussion about your mortgage business.

In one platform, you can manage all discussions about your business across the web, so you can quickly address any negative feedback, or join in on a positive discussion.

ContentStudio

ContentStudio is a content marketing and social media management platform that mortgage professionals can use to create and distribute their content across channels.

The platform allows you to research content in hundreds of categories, so you can see what’s trending in the mortgage industry and create your own relevant content. Then, you can publish it across all your channels and track engagement.

Customers love that you can manage all conversations across your social media channels in one place, for faster response times.

How to use content as part of your social media marketing strategy

A lot of mortgage professionals think the most important part of their overall marketing plan today is social media.

While social media is important, think of it as a part of your content marketing strategy, since the content you put on your channels has to set you up for success and lead you back to your website for conversions.

Tip: Remember that social media channels can change the rules on you. Don’t spend tons of time building a following on a particular channel. Eventually, it will charge you to get the same reach you did before for free. Build a following primarily on owned media channels like your website or an email list.

From this perspective, social media becomes a true supporting player in your content strategy.

Content for social media might include:

- Links to blog posts or YouTube videos

- Infographics

- Webinars

- Photos

- Customer testimonials

- Surveys, quizzes, or polls

All content will include some sort of call-to-action, so your customers can easily take their next steps to reach out or apply.

Content marketing examples

Now that we’ve discussed how content marketing helps you generate qualified mortgage leads, let’s dig into some actual examples of the ways businesses generate exclusive leads via content marketing.

Unique blog posts that explain the mortgage process

To create the right types of content, you need to understand your clients. Who are they? What are they struggling with? What do they want to know?

Create client personas

Creating client personas is necessary when you’re getting started with content. You can point to these personas as a guide for who you’re writing to and their specific needs.

Your blog content will help you build a relationship with your current and future clients by speaking directly to them and positioning yourself as an expert in the industry.

A successful content strategy starts with high-quality content, but then you have to optimize it to guarantee your mortgage leads. This means you’ll insert relevant keywords, add links, and carefully place calls to action throughout the page.

Providing useful information via blogging is great, but you won’t seal the deal without reminding the reader where the content is coming from (you, the mortgage expert), who can help them, and how, in the form of strategically placed calls-to-action.

So, what types of content do you think your readers want? It’s helpful to start with general topics, and gradually build on them.

You might start with the following topics:

- Interpreting the latest mortgage news, and what it means for your clients

- A step-by-step guide to the homebuying process

- Comparison of your two most popular loan options

- Pros and cons of conventional loans

- How to get preapproved for a mortgage

- The best time to buy a house

- How to choose a mortgage lender

- How long the homebuying process takes

- How to refinance

The way you write should be easily digestible for those who may have zero experience with the mortgage process. You’re trying to make yourself accessible to a wide range of borrowers, so you need to speak directly to them.

On the other hand, if you’re speaking to an experienced real estate investor about DSCR or jumbo loans, you’ll want to adjust your language to match that audience. Always keep in mind your client personas.

Organize your blog posts

You’ll want to organize your mortgage marketing blogs simply, starting with defining your topic and answering the reader’s questions as you move along.

For example, if you’re writing an article on the pros and cons of conventional loans, you might organize the headings like this:

- What is a conventional loan?

- How does a conventional loan work?

- What are the pros and cons of conventional loans?

- How do I get a conventional loan? (Call-to-action for your services)

You don’t have to write all your blog content yourself, but it’s important to have a regular schedule of posts. Google likes to rank fresh, regular content in search.

If you need help with your content, My Perfect Leads’ sister company Kaleidico offers content marketing services that are based on SEO research, competitive analysis, and the customer’s buying journey.

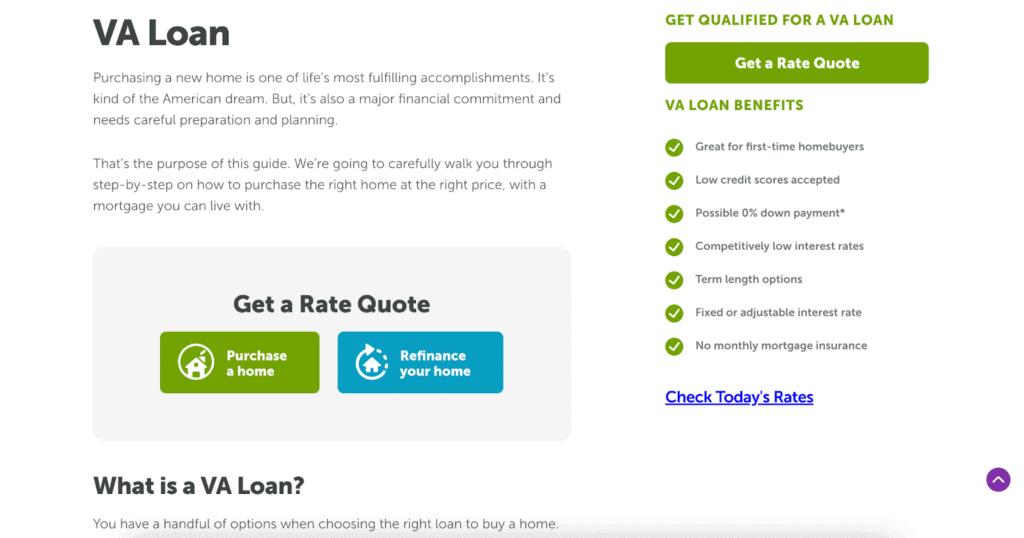

Dynamic pages for each loan product and loan officer

What’s your current mortgage website structure? Does your site consist of a simple homepage, or do you have landing pages for each loan product?

Boost your mortgage leads by adding more landing pages. Landing pages are essential for not only sharing more helpful information about what you offer but for inserting effective calls-to-action and more keywords.

Remember, your landing pages actually aren’t about you or why you’re good at what you do. Instead of telling your visitors this, show them by explaining the benefits of each loan product and how you can help them get the loan.

For example, on a VA loan landing page, explain the types of borrowers who qualify for a VA loan, the major benefits of the loan, and how to apply. You can even throw in an FAQ accordion to address some most-asked questions about this type of loan.

Keep your landing pages simple, yet filled with concise, relevant, helpful information that persuades your reader to move forward with the CTA.

You also should create separate landing pages for mortgage rates and news, your loan officer directory, and a contact page.

Creating separate pages for each of your lenders and loan officers allows you to capture more leads via those individuals.

If someone is searching for a specific lender, their landing page is sure to be No. 1 in search if you have a clean, optimized landing page for them.

Does all this sound like too much work? Sign up to purchase leads now.

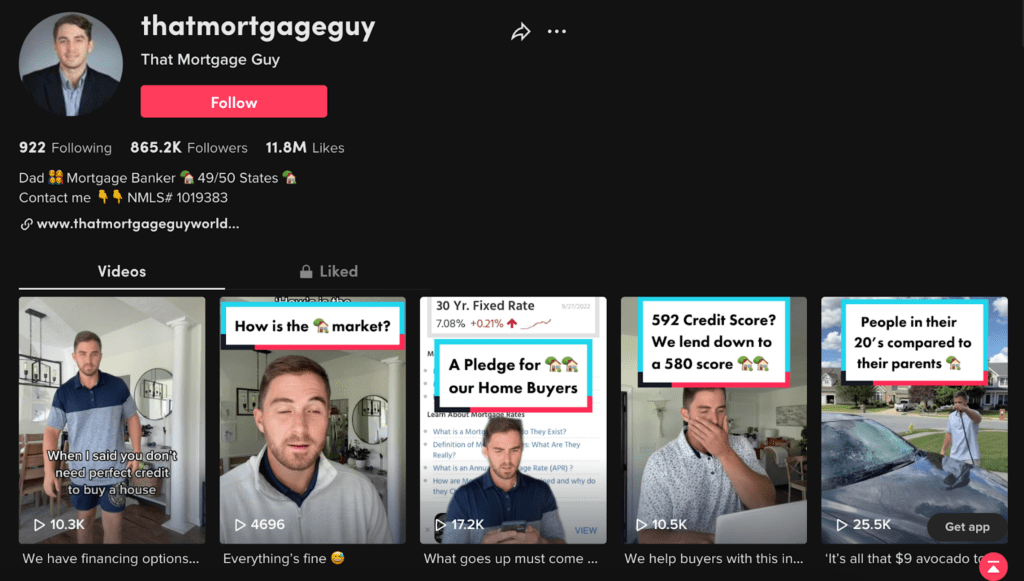

Going “live” or sharing videos on Facebook, TikTok, or Instagram

Do you have what it takes to be the next “viral” mortgage lender?

This of course doesn’t need to be your goal, but if you have the energy and the personality, why not put yourself out there on social media?

Take part in the latest TikTok trend, but switch it up for mortgage news or learning opportunities.

The homebuying process is still a mystery for a large number of adults, regardless of age. Meeting your potential customers online can be a fun way to build a following that sticks.For example, when I did a search on Google for “mortgages TikTok” the first result was That Mortgage Guy. He’s a mortgage banker with over 800,000 TikTok followers and nearly 12 million “likes” for his entertaining videos on credit scores, the housing market, and more.

People are hungry for information, but they want it presented to them in a way that’s engaging and entertaining.

Share tips about loan pre-approval, home improvements, or the best places to buy a home right now in short videos on social media, and link to a certain blog post or landing page for more info.

Schedule a time to go live on Facebook or Instagram for an exclusive mortgage Q&A with your followers, and offer them access to a mortgage marketing lead magnet, like a checklist or worksheet, if they attend.

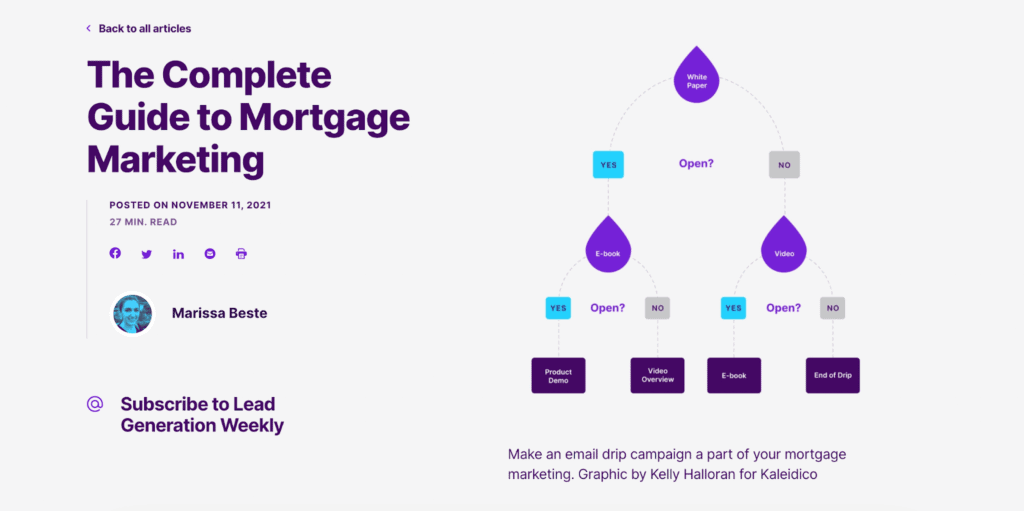

Beautiful infographics that are made for sharing

Part of what helps make your content attractive and engaging are photos and infographics. Remember that when Google scans your content, it’s checking for the use of images, too.

Studies have shown that infographics are 30 times more likely to be read than a full article, and publishers that use infographics generate 12% more traffic than the ones that don’t.

Include photos or infographics on your blog posts and landing pages, and create additional infographics to summarize information from an article or webinar for your social media channels.

Mortgage information offers perfect opportunities for infographics, since you can pack important data and tips into an easily digestible format that people can share and save.

The example above shows an infographic on email drip campaigns we placed in one of my articles on mortgage marketing.

Informative, trendy weekly newsletters

One of the most valuable things a mortgage professional can do for their potential leads is to interpret the current news and explain what it means for them.

Mortgage news is always trendy, because it affects so many people. In the current climate, mortgage interest rates, home prices, and home sales are a hot topic, but it can be difficult for the average borrower to understand how it affects them specifically.

Oftentimes, the bottom line to all this news is that despite the fluctuating rates and prices, the best time to buy a home is different for each person.

Help your potential customers interpret which news really affects them, and how they can use that information in their home search or refinance.

You can offer budgeting tips, explain how to use a mortgage calculator (and link to it on your website), and encourage them to reach out so you can discuss their unique borrower scenario one-on-one.

Give your newsletter a personal touch by sharing your own mortgage stories, client stories (with permission), and any news about your office or loan officers that your readers may find interesting.

A big trend in content marketing examples is getting personal to build trust. People want to feel like they are really connecting with you and can trust you because the web can be so vast and impersonal.

If you want people to find you online and start the mortgage process through your website, you need that trust to convince them to move ahead with confidence. A newsletter can help you connect with current and future clients.

Webinars to dive deeper into mortgage topics

A webinar is an event that keeps on giving.

Host a webinar on your own or with your referral partners, such as a real estate agent or lawyer, and go in-depth on a topic.

Include plenty of engagement features, such as a Q&A session, survey, slideshow or video presentations, and more.

Then, you can keep using this content in different ways for months. Here are some examples:

- Edit video clips from the webinar to embed in blogs or share on social media

- Create and share infographics across your channels

- Spark a discussion on your survey results or most-asked questions

- Schedule several blogs based on topics or questions that were discussed

- Offer the full webinar recording as a lead magnet

What is a lead magnet? We’ve touched on a few lead magnet ideas throughout this article. Let’s take a look at what they are and how they work as part of your mortgage content strategy.

Valuable lead magnets

Lead magnets are a piece of content that offers more value to potential clients in exchange for their contact info.

Because you’re trying to convince your web visitors to give you their information, such as their email addresses, you need the lead magnet to be something special.

Examples of lead magnets for mortgage lead generation include:

- Complete guides or eBooks on parts of the mortgage/homebuying process

- Video series

- Webinar

- Case study

- Checklists or tip sheets

You can place the lead magnets around your website or even include them in ads on social media.

Lead magnets are an excellent way to collect exclusive leads because you’re asking for something simple (an email address) in exchange for something free and valuable that your potential client would want.

Friendly, fun, and timely email campaigns

Email marketing is an essential part of content marketing for mortgage companies because it’s a major lead nurturing tactic.

Once you have your leads, how do you plan to keep them? Email allows you to keep in touch with past and future clients who may not need you right this second, but will again in the future.

The brand I seem to open emails from the most is Warby Parker. Most people only buy a new pair of glasses every few years, so this brand needs to work to keep in touch with past customers like me.

Their subject lines and use of a bold photo capture my attention, and make me feel like they’re personally reaching out based on my past purchase.

Your email marketing for mortgages can be light-hearted and fun, and you can even create a special monthly newsletter specifically for this audience.

With a quality mortgage CRM, you’ll have access to important information about your clients that you can use to target them with email.

For example, you can send out birthday or holiday greetings with a quick, personal video. This is a simple way to keep in touch and stay on the minds of your clients.

This sounds like a lot of work. What are alternatives?

Of course, creating a lead generation machine is not on everyone’s list of life goals. Truth be told, it’s one of the hardest things to do in business. Period.

That’s because it could take years of hard work before you see just a few leads come in.

Yes, eventually you’ll have to do nearly zero work and leads will still flow. But this is a long road.

That’s why we’ve set up My Perfect Leads. We’ve already created the online lead generation machine for you. You just buy the leads and be done with it.

Ready to get started?

See if our lead buying program is right for you.

Photo by Mikael Blomkvist